Last Updated on September 11, 2025 by Ideal Editor

Turkey Apartment Sales Rise: Quick takeaway 🏠📈

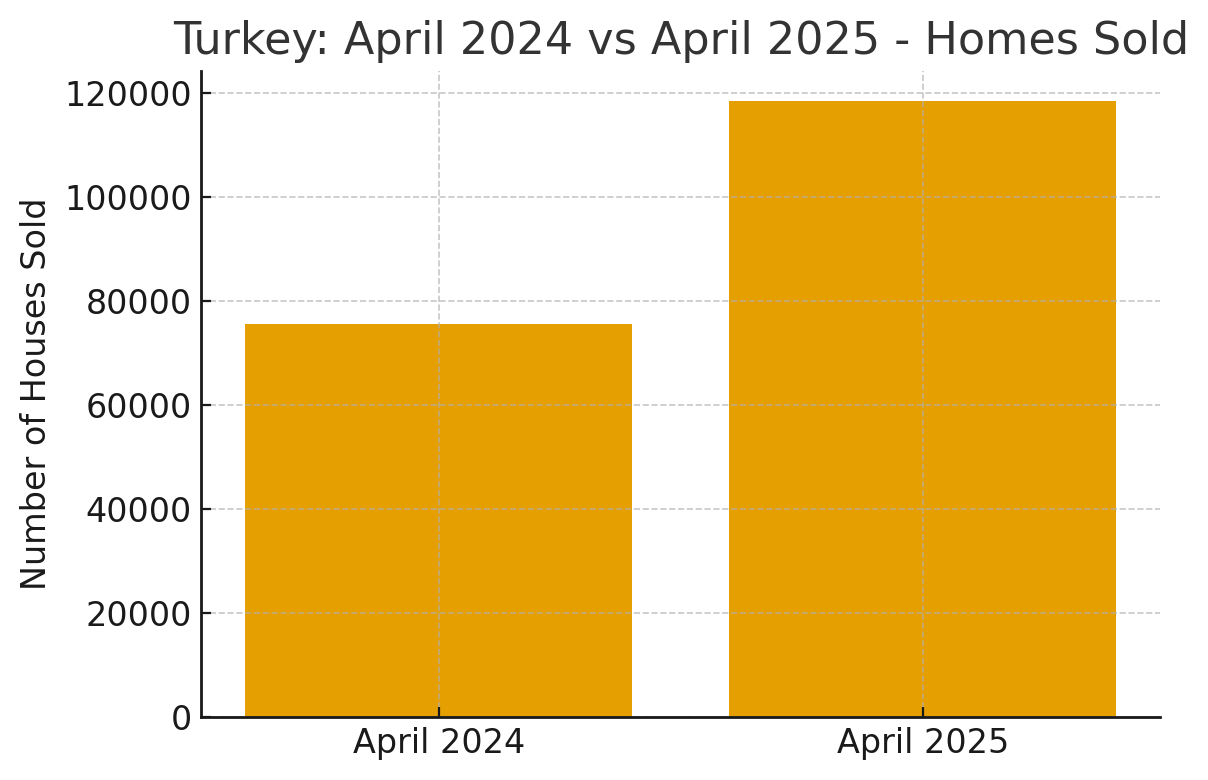

April 2025 saw a dramatic rebound in Turkey’s housing market: total home sales jumped to 118,359 units, a 56.6% year-on-year increase — The Turkey Apartment Sales Rise was led by large urban markets (Istanbul, Ankara, Izmir) and a sharp recovery in mortgage-backed purchases.

What happened — the headline numbers explained 📊

Turkey’s residential property market posted a striking movement in April 2025:

- Total homes sold (April 2025): 118,359 units — +56.6% YoY.

- Top-selling provinces: Istanbul led the pack with 18,645 sales in April (followed by Ankara and Izmir).

- Mortgage-backed transactions climbed strongly (17,465 mortgage sales in April — a large percentage jump), signalling a return of bank lending to the market.

- Cumulative Jan–Apr 2025 sales: 454,145 homes (+27.9% vs same period previous year).

- For context, total homes sold in 2024 reached ~1,478,025 (a 20.6% increase over 2023).

These are the most important load-bearing facts driving investor interest and market sentiment today. The charts and tables included below visualize the jump and the changing sales mix.

Visual snapshot — charts & quick table 📉📋

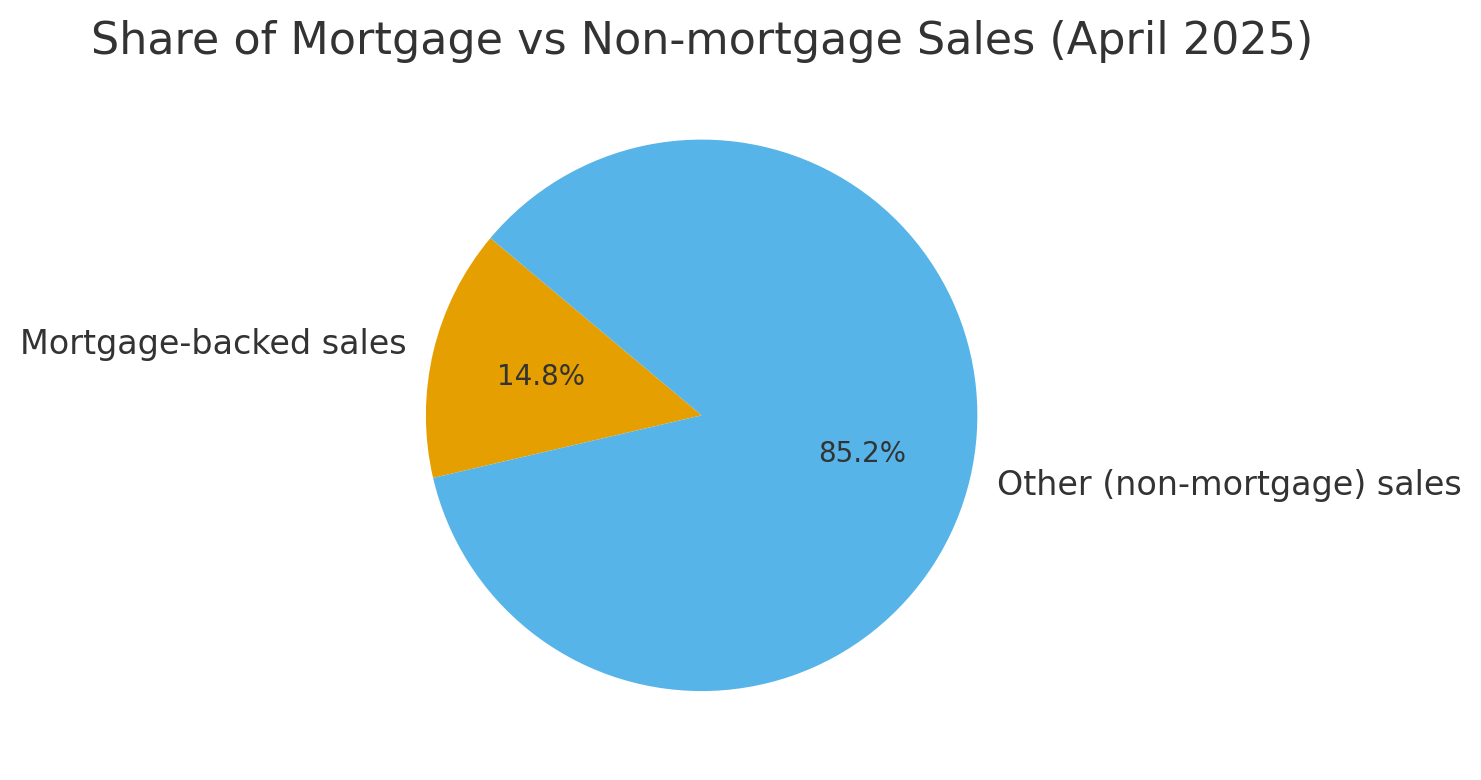

(You should see a bar chart comparing April 2024 vs April 2025 and a pie chart showing mortgage vs non-mortgage share. A compact summary table lists the key metrics and the top provincial sales.)

What these visuals show at a glance:

- The market’s rebound is large — April 2025 volumes are well above April 2024 baseline.

- While most purchases remain non-mortgage (cash/other), mortgage activity is re-emerging and now represents a meaningful share of monthly sales.

(Charts and tables displayed above.)

Why sales spiked — supply, demand & policy drivers 🔍

1) Mortgage rehabilitation and credit availability 🏦

After a period of very elevated interest rates, mortgage markets eased in recent months and lenders restarted more active consumer lending. The rise in mortgage-backed sales was a primary fuel for the April spike.

2) Restored buyer confidence and pent-up demand 💡

Domestic buyers — especially in big cities — reacted to improved affordability or the perception of better financing. This drove higher resale and new-build transactions across the largest provinces.

3) Urban concentration of transactions 📍

Istanbul, Ankara and Izmir concentrate the most demand: Istanbul alone accounted for ~18,645 sales in April. Urban markets remain the primary engine for national volume increases.

4) Seasonal and structural factors 🔁

Spring months often show stronger activity as buyers re-enter the market after winter slowdowns. Combined with macro adjustments, seasonality amplified the month-on-month rise.

Province breakdown — where the demand concentrated 📍

Top provinces (April 2025)

- Istanbul — 18,645 homes.

- Ankara — 10,889 homes.

- Izmir — 7,014 homes.

Lowest recorded provincial sales (April 2025)

- Ardahan — 37 homes.

- Tunceli — 75 homes.

- Bayburt — 88 homes.

Key takeaway: demand is concentrated in big metropolitan areas; regional differences remain large, which matters for investors picking assets by liquidity, rental market strength, and exit options.

Mortgage vs non-mortgage sales — what the split means 🧾

- Mortgage-backed sales (Apr 2025): 17,465 units — roughly 14.8% of April transactions.

- Non-mortgage transactions (cash, other) still represented the majority — often buyers repositioning capital into property or investors buying directly.

Interpretation: mortgage recovery signals improving bank appetite and buyer affordability. If credit continues to expand, expect a healthier resale market and more first-time buyer activity.

Market outlook — short to medium term perspective 🔭

Bullish signals

- Re-opening mortgage channels supports sustained demand for mid-market housing.

- Urban rental markets still strong, supporting buy-to-let strategies in key provinces like Istanbul and Izmir.

Risks to watch

- Macro volatility (inflation, currency swings) could affect investor sentiment and foreign purchasing power.

- Mortgage rates and central bank policy remain the primary lever — any reversal could slow momentum.

Investor action points

- Favor properties with strong rental demand and clear exit routes (central Istanbul suburbs, Izmir, parts of Ankara).

- Watch mortgage policy announcements and monthly sales releases for timing purchases.

How Ideal Estates can help you navigate this market ✅💼

Ideal Estates offers an end-to-end partnership for investors, buyers and sellers looking to capitalize on Turkey’s renewed housing momentum:

- Data-driven property selection — we screen neighbourhoods by liquidity, rental yield, price trajectory and proximity to transport/amenities.

- Mortgage advisory & financing introductions — our partners include trusted local banks and mortgage brokers to help secure competitive financing when available.

- Portfolio optimisation — whether you’re buying one apartment or building a multi-unit portfolio, we help structure acquisitions for tax efficiency, rental yield, and long-term appreciation.

- Full transaction support — legal checks, due diligence, negotiation, notary and title transfer handled by experienced in-country lawyers.

- After-sales & property management — tenant sourcing, maintenance and asset management services to protect your returns.

Why Ideal Estates? Because we combine on-the-ground market expertise with clear investor processes, and we prioritise transparency and after-sales service. Put simply: we reduce complexity and risk, accelerate deal flow, and help you act quickly when the market signals change.

Practical steps for buyers and investors — quick checklist 📝

- ✅ Set clear goals: capital appreciation, rental income, citizenship? Your strategy determines location and asset class.

- ✅ Check financing: confirm mortgage availability and rates before committing.

- ✅ Due diligence: title checks, building permits, and second-opinion valuations.

- ✅ Liquidity plan: choose assets in districts with strong transaction volumes to ensure exit flexibility.

- ✅ Work with local experts: real estate agents, lawyers, tax advisors — Ideal Estates can coordinate these partners.

FAQs — Top 5 questions from buyers & investors on Turkey Apartment Sales Rise 💬

1. Is this April spike sustainable?

It depends on credit conditions and macro stability. The jump reflects renewed mortgage activity and seasonal demand. If mortgage availability continues and broader economic indicators stabilise, elevated sales could persist.

2. Are foreign buyers playing a role in the surge?

April’s jump was primarily domestic. Sales to foreigners have fluctuated, but local demand and mortgage recovery were the primary drivers.

3. Which provinces offer the best short-term rental yields?

Istanbul and Izmir generally offer the largest tenant pools and best liquidity; specific neighbourhood yield depends on property type and micro-location. Ideal Estates can provide targeted yield analyses.

4. How important is mortgage financing for first-time buyers today?

Very important: mortgage access widens affordability for many buyers. The April data show mortgage activity rebounding, which opens the market to more homebuyers.

5. Should investors buy now or wait for clearer trends?

If you have long-term horizons and target assets in high-demand urban areas, today’s market can be attractive — especially if you secure favourable financing. For short-term speculative plays, watch monthly statistics and central bank signals closely.

Final thoughts on Turkey Apartment Sales Rise — how to act on this moment 🚀

April 2025’s 56.6% surge is a clear market signal: domestic demand has returned and mortgage channels are reopening. For investors and owner-occupiers, this creates both opportunity and urgency — particularly in liquidity-rich cities such as Istanbul. Ideal Estates is positioned to help you evaluate opportunities, structure transactions, and manage assets end-to-end.

Call to action 📞📧

Ready to explore Turkey’s hottest neighbourhoods or want a personalised market briefing?

Contact Ideal Estates today — we’ll provide a custom property shortlist, mortgage pre-check, and a step-by-step acquisition plan tailored to your investment goals.

Subscribe to our newsletter for monthly Turkey housing updates and market reports.